Our goal is to make it as easy as possible for you to learn how ACSTO works; how to make and claim your donation; and how to share with your friends and family about how they also can make Christian Education affordable through this program. Below you'll find a selection of our most popular Donor Resources. As always, if you have questions, or you're looking for something else, contact one of our friendly Customer Service Specialists today!

What's a Tax Credit?

Maybe you've heard people talk about tax credits before, but you left with more questions than answers. Our short, two-minute video simply explains how tax credits work—share it with your friends!

Brochures

Looking for a copy of one of our brochures? Download them below, or if you'd like physical copies, contact our office today and we'll gladly mail them to you.

| Donation Brochure | Out of State Donors | Withholdings |

Partner Schools

Want to help support Christian Education in your community, but not sure which schools are close to you? Our Partner School list is sorted by city, and names more than 130 schools that are providing thousands of Arizona students with a faith-based education.

Tax Credits Worksheet

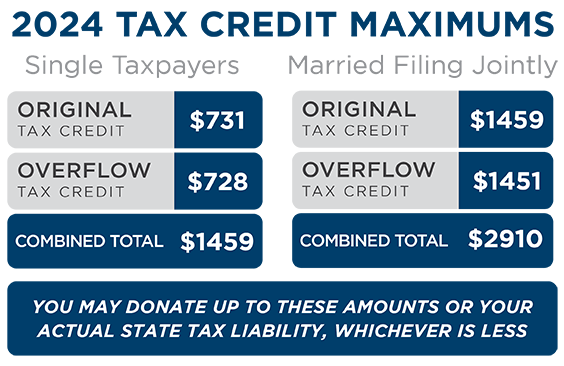

If you still have extra tax liability after donating toward the Private School Tax Credit, you can take advantage of some of Arizona's other tax credits, too! Use this worksheet to help plan your tax credit donations.

Claiming Your Credit

Filing your own taxes can sometimes be confusing. Our short video walks you through how to read your donation receipt, which tax forms to fill out, as well as what each section of your tax forms means.

Certification

ACSTO is certified as a school tuition organization (STO) by the Arizona Department of Revenue. In addition, ACSTO is a federally approved 501(c)(3) charitable organization. Learn more and view our certification on our ADOR Certification page.