We created this short video to show you how to claim the tax credit for your ACSTO donation. It walks you through how to read your receipt, which tax forms to fill out, as well as what each section of your tax forms means.

This video focuses on filing paper tax returns. If using common tax preparation software, it should ask you about any giving you did during the year and account for your tax credit donation automatically.

IMPORTANT! The Private School Tax Credit DOES NOT require an organization/school code to claim the credit on your state taxes. If a code is requested, please confirm you have selected the Private School Tax Credit, or that you are using Arizona Form 323 (and Form 348, depending on your donation amount).

Receipts

If you have Donor Portal account and donate through it, you may print or download your receipt right away. If you created a portal account but donate as a Guest (online), by phone, or by mail, your receipt will be available in your portal the day after ACSTO processes your donation.

For donors without a Donor Portal account, an annual receipt statement will be mailed by January 31 of the following year. If a receipt is needed sooner, please call our office at 480.820.0403.

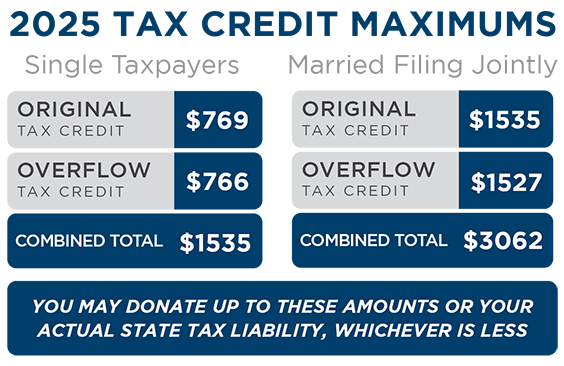

The receipt will have your donation broken down between the Original and Overflow Tax Credits, and will indicate what amount to claim and which tax forms to use.

Tax Forms

If you're filing paper tax returns, you'll need a couple of short forms in order to claim your tax credits. You'll need Form 301 (Summary of All Arizona Credits) and Form 323 (Original Tax Credit) for sure, while some donors may also need Form 348 (Overflow Tax Credit).

NOTE: If you're claiming a tax credit, you cannot use the short forms 140A or 140EZ, as these forms do not have fields for the tax credits.

| 2024 | Instructions | |

|---|---|---|

| Form 301 (Summary of Tax Credits) | ||

| Form 323 (Original Tax Credit) | ||

| Form 348 (Overflow Tax Credit) |

Other Tax Credits

In addition to the Original and Overflow Tax Credits, Arizona offers several other tax credit opportunities for charitable organizations, foster care, public schools, and military families. You can donate to as many of these different tax credit programs as you like, as long as you have the state tax liability to do so.

Remember, ACSTO only deals with the Individual Private School Tax Credits (Original and Overflow); we cannot accept donations for any other type of tax credit.

If you plan on taking advantage of other tax credit opportunities, we encourage you to speak with your tax advisor to determine how much you can donate and claim a credit for.