Ready to help make Christian Education affordable for an Arizona student, but not sure how much you should donate? This short video explains the maximum tax credit amounts, and will also help you figure out what your tax liability is—or continue reading below for more information!

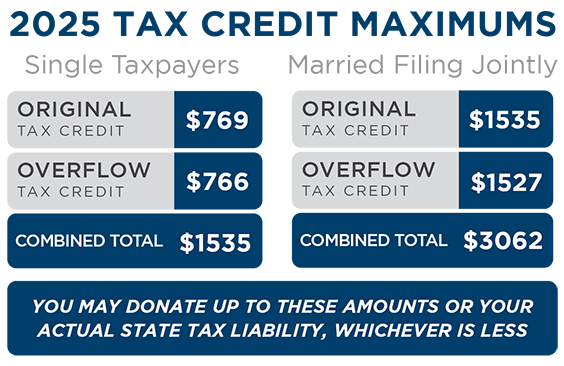

For Tax Year 2025, a married couple filing jointly can claim a maximum credit of up to $3,062, a single taxpayer up to $1,535, or their total tax liability, whichever is less. These amounts are the total of Arizona's two Private School Tax Credits for individual taxpayers—Original and Overflow.

When giving to ACSTO, donors can give up to $1,535/$769 (married/single) toward the Original Tax Credit. Any donation above this amount will then go toward the Overflow Tax Credit, up to a maximum of an additional $1,527/$766. When you donate through ACSTO's Donor Portal, it automatically totals the amounts for Original and Overflow so you don't have to.

2025 Maximums

| Filing Status | Original Tax Credit | Overflow Tax Credit | Total Credit |

|---|---|---|---|

| Single Taxpayer | $769 | $766 | $1,535 |

| Married Filing Jointly | $1,535 | $1,527 | $3,062 |

NOTE: The maximum is either the above amount, or your total tax liability, whichever is less. If you donate more than your total liability, Arizona law allows you to carry the excess credit (up to the maximum) forward for use in up to five consecutive future tax years. The tax forms you use to claim the credit (Arizona Forms 323 and 348) are also used to track any carryover.

How do I figure out my liability?

Since you can only claim a tax credit up to your state income tax liability, but no more than the maximum amounts allowed, knowing how to figure out that amount is important. The good news? It’s much easier than you might think!

Take a look at your most recent Arizona tax return, and find your Form 140. On page 2, locate the line that says, "Balance of Tax." The amount on that line is your tax liability for that tax year. This is how much you are responsible for paying in Arizona taxes for that year—whether you pre-paid the full amount through your paycheck withholdings, or you still owe. This is also the amount that determines how much you can claim in tax credits for that particular tax year.

Don't forget, you can donate any time before you file your taxes (all the way up until Tax Day!), whichever comes first. This allows donors time to prepare their taxes, calculate their "Balance of Tax," then donate to ACSTO before filing their taxes. This way they know exactly what their total liability is so that they don't under-donate, but they also don't over-donate and create a carryover situation.

Sample Tax Forms

These sample tax forms provide great examples of how donating to ACSTO may affect your Arizona taxes. We’ve highlighted the most important lines to make it easy for you to follow along with our "How Much Can I Donate?" video, find your "Balance of Tax," and see how tax credits can help you owe less, or get an even bigger refund.

Tax Credits Worksheet

If you still have extra tax liability after donating toward the Private School Tax Credit, you can take advantage of some of Arizona’s other tax credits, too! Use this worksheet to help plan your tax credit donations.

TAX DAY DEADLINE

Tax credit donations can be mailed or submitted online to ACSTO prior to filing taxes, but no later than Tax Day (whichever comes first), and still be eligible for the tax credit for the previous tax year. For donations made between January 1 and Tax Day, it is up to the donor to determine if the tax credit will be claimed for the previous or current tax year. If claiming for the prior year, donations must be postmarked or submitted online prior to midnight on Tax Day—even if you plan on filing an extension.

RECOMMENDATIONS

Arizona law allows donors to recommend a student when making their donation, however, a recommendation is not a guarantee of a scholarship award. This is because Arizona law and ADOR regulations state that, "A school tuition organization cannot award, restrict, or reserve scholarships solely on the basis of a donor's recommendation." Recommendations are one of the three criteria our Selection Committees consider when making scholarship awards, in addition to the Financial Circumstances of the student's family (a required factor by state law) and the Narrative provided in the Scholarship Application.

A taxpayer may not claim a tax credit if the taxpayer agrees to "swap" donations with another taxpayer to benefit either taxpayer's own dependent (for example, swapping recommendations with another parent for each other's children is prohibited, even in groups of three or more). A taxpayer also may not recommend his/her own child or dependent.

Overflow Scholarship Eligibility

All students who have submitted a current Scholarship Application to ACSTO are eligible for Original Scholarships, however, only certain students also qualify for Overflow Scholarships. To qualify for Overflow, the student must meet one of the following criteria:

- The student attended an Arizona district or charter school for at least 90 days in the prior school year, then transferred to a private school.

- The student is a preschooler with disabilities and is receiving services from a private school based on an MET or IEP they received from an Arizona public school.

- The student is currently enrolled in Kindergarten at a private school.

- The student is a dependent of a member of the U.S. Armed Forces who is stationed in Arizona under military orders.

- The student was homeschooled in Arizona and did not have an ESA immediately prior to enrolling in a private school.

- The student moved to Arizona from out of state immediately prior to enrolling in a private school.

- The student participated in the ESA program and did not renew or accept the scholarship in order to accept STO scholarships.

- The student previously received an Overflow or Corporate Scholarship in a prior year, and has attended private school continuously since.

CHARITABLE GIVING

Since ACSTO is a certified 501(c)(3) charitable organization, any giving which goes above and beyond the allowed tax credit maximums can still be treated as a charitable deduction. In addition, donations made by taxpayers who have no Arizona tax liability would fall under this category. Donations of these types will appear in a separate column on your ACSTO donation receipt labeled "Other Contributions." For more information about claiming your ACSTO donation as a charitable gift, we encourage you to speak to your tax advisor. Please note that the donation deadline for charitable deductions is December 31.

HAVE QUESTIONS?

Give us a call at 480.820.0403 today—we'd love to help! Our office is open Monday–Friday between 9am–12pm and 1pm–4pm. Can’t call us during that time? No problem—contact us online, and we'll get back to you within one business day.