A tax credit is money that taxpayers receive back dollar-for-dollar from the state for their donation, which goes against what they would otherwise owe as a state tax payment.

We created this short video to give you a visual about how ACSTO works. Unable to watch, or can’t listen right now? Read below for more!

If you're an Arizona taxpayer, you can make a donation to ACSTO and receive a dollar-for-dollar state tax credit in return! But what does that mean?

This is because a tax credit is different than a normal charitable deduction. Rather than reduce your taxable income, a tax credit directly reduces your state tax liability (a.k.a. the tax you pay). For example, if your tax liability (obligation) is $1,000, and you make a $750 donation to ACSTO, your liability will be reduced by $750—meaning that your tax liability will only be $250! Keep in mind, if you usually receive a refund, a tax credit makes it bigger—it is to your advantage to participate in this program.

In addition, you can donate up until Tax Day or before you file your taxes (whichever of these comes first) and still claim the credit for the previous tax year. If you are filing an extension, donations must be made by Tax Day to claim the tax credit for the prior tax year.

The best part? ACSTO uses your tax credit donation to award tuition scholarships to Christian School students attending one of our Partner Schools. When you make a donation, you can identify a specific school, or even recommend a specific student to be considered for a scholarship!

Not sure how much to give? Check out our video.

What are you waiting for? More than 105,000 Arizona taxpayers have already joined us to make Christian Education affordable for 50,000 students!

TAX DAY DEADLINE

Tax credit donations can be mailed or submitted online to ACSTO prior to filing taxes, but no later than Tax Day (whichever comes first), and still be eligible for the tax credit for the previous tax year. For donations made between January 1 and Tax Day, it is up to the donor to determine if the tax credit will be claimed for the previous or current tax year. If claiming for the prior year, donations must be postmarked or submitted online prior to midnight on Tax Day—even if you plan on filing an extension.

RECOMMENDATIONS

Arizona law allows donors to recommend a student when making their donation, however, a recommendation is not a guarantee of a scholarship award. This is because Arizona law and ADOR regulations state that, "A school tuition organization cannot award, restrict, or reserve scholarships solely on the basis of a donor's recommendation." Recommendations are one of the three criteria our Selection Committees consider when making scholarship awards, in addition to the Financial Circumstances of the student's family (a required factor by state law) and the Narrative provided in the Scholarship Application.

A taxpayer may not claim a tax credit if the taxpayer agrees to "swap" donations with another taxpayer to benefit either taxpayer's own dependent (for example, swapping recommendations with another parent for each other's children is prohibited, even in groups of three or more). A taxpayer also may not recommend his/her own child or dependent.

Overflow Scholarship Eligibility

All students who have submitted a current Scholarship Application to ACSTO are eligible for Original Scholarships, however, only certain students also qualify for Overflow Scholarships. To qualify for Overflow, the student must meet one of the following criteria:

- The student attended an Arizona district or charter school for at least 90 days in the prior school year, then transferred to a private school.

- The student is a preschooler with disabilities and is receiving services from a private school based on an MET or IEP they received from an Arizona public school.

- The student is currently enrolled in Kindergarten at a private school.

- The student is a dependent of a member of the U.S. Armed Forces who is stationed in Arizona under military orders.

- The student was homeschooled in Arizona and did not have an ESA immediately prior to enrolling in a private school.

- The student moved to Arizona from out of state immediately prior to enrolling in a private school.

- The student participated in the ESA program and did not renew or accept the scholarship in order to accept STO scholarships.

- The student previously received an Overflow or Corporate Scholarship in a prior year, and has attended private school continuously since.

CHARITABLE GIVING

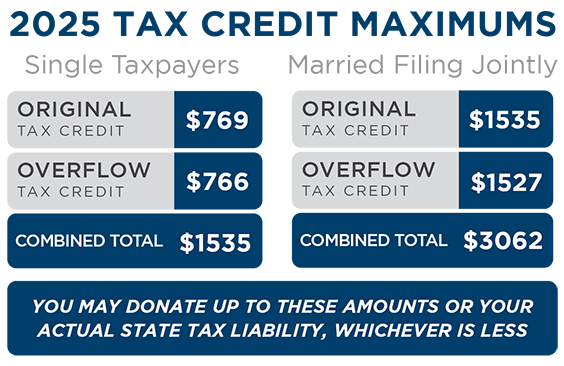

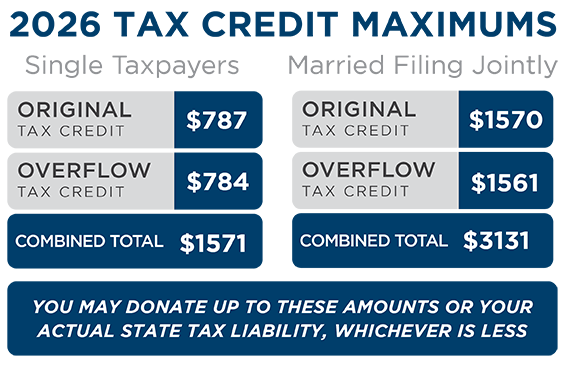

Since ACSTO is a certified 501(c)(3) charitable organization, any giving which goes above and beyond the allowed tax credit maximums can still be treated as a charitable deduction. In addition, donations made by taxpayers who have no Arizona tax liability would fall under this category. Donations of these types will appear in a separate column on your ACSTO donation receipt labeled "Other Contributions." For more information about claiming your ACSTO donation as a charitable gift, we encourage you to speak to your tax advisor. Please note that the donation deadline for charitable deductions is December 31.

HAVE QUESTIONS?

Give us a call at 480.820.0403 today—we'd love to help! Our office is open Monday–Friday between 9am–12pm and 1pm–4pm. Can’t call us during that time? No problem—contact us online, and we'll get back to you within one business day.