What types of scholarships are available?

In Arizona, there are four different tax credit scholarship programs available to help families afford a private education. Two of the programs are funded by Individual taxpayers; the other two are funded by Corporate taxpayers.

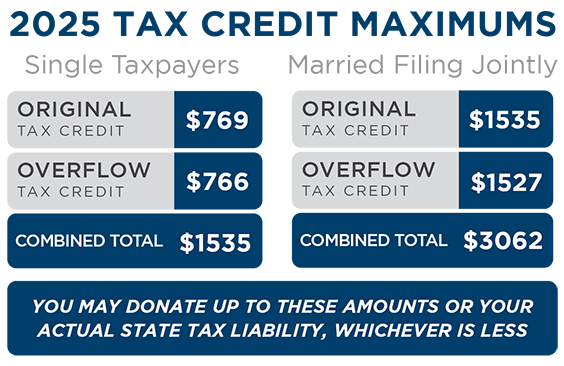

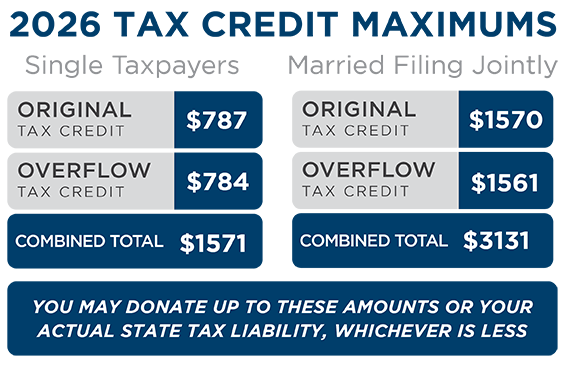

ACSTO awards scholarships through the two Individual tax credit programs: Original and Overflow. Our sister organization, School Choice Arizona, awards scholarships through the Corporate tax credit program. For more information on Corporate scholarships, visit schoolchoicearizona.org.

Original Scholarships are funded through the Original Individual Tax Credit Law, enacted in 1997 as A.R.S. 43-1089. Any student enrolled in a private school in grades K-12 (or a preschooler with disabilities) qualifies for this scholarship.

Overflow Scholarships are funded through the Switcher Individual Tax Credit Law which took effect in August 2012 as A.R.S. 43-1089.03. To be eligible, students must meet one of the requirements below.

- The student attended an Arizona district or charter school for at least 90 days in the prior school year, then transferred to a private school.

- The student is a preschooler with disabilities and is receiving services from a private school based on an MET or IEP they received from an Arizona public school.

- The student is currently enrolled in Kindergarten at a private school.

- The student is a dependent of a member of the U.S. Armed Forces who is stationed in Arizona under military orders.

- The student was homeschooled in Arizona and did not have an ESA immediately prior to enrolling in a private school.

- The student moved to Arizona from out of state immediately prior to enrolling in a private school.

- The student participated in the ESA program and did not renew or accept the scholarship in order to accept STO scholarships.

- The student previously received an Overflow or Corporate Scholarship in a prior year, and has attended private school continuously since.

How do I receive a scholarship for my child?

First, create a Parent Portal account and apply for scholarships for each of your students. You may also print an application and submit the completed application to us by mail, fax, or email it to applications@acsto.org.

Only one application is required per school year. Application Deadlines can be found here. Applications expire at the end of the school year, regardless of when they are received.

Once an application is submitted, your student will be considered for scholarships in each Award Cycle during the school year as long as your student is enrolled at the school named on the application.

Next, learn how the Private School Tax Credit Program works to make Christian Education affordable for families. Take advantage of our great Parent Resources and attend a Parent Workshop.

How are scholarships awarded and what factors are considered?

Every student who has a current application on file, is enrolled, and meets the qualifications of each type of scholarship is considered.

Our Selection Committees consider three factors when making award decisions:

- Family Financial Information provided on the application

(This is a required factor by state law. It is held in strictest confidence.) - Student Narrative provided on the application

- Donor Recommendations received for the student

By law, donor recommendations are not guaranteed. However, they do help in the award decision process.

Regardless of our desire to award every student during each Award Cycle, we do not always have the funds available to meet this goal since we are a donation-based organization.

What if my student receives an award but transfers to another school?

As long as the new school is a private Christian School in Arizona that partners with ACSTO, the unused portion will follow the student. Otherwise, any remaining scholarship amount would be awarded among other students at that school. For a list of our Partner Schools, click here.

May a student receive funds from more than one school tuition organization (STO)?

Yes, we encourage you to apply for any opportunities available. Our number one goal is for you to afford a Christian Education for your child.

If my student receives funds from an Empowerment Scholarship Account (ESA), can they also receive a scholarship from an STO?

Tax credit scholarships and ESA funds cannot be used at the same time to pay a student's tuition. Students receiving ESA funds may still be considered for and awarded tax credit scholarships, but awards will be held in the student's name as Multi-Year Scholarships to be used in a future school year after the ESA is terminated. ACSTO can continue to hold Multi-Year Scholarships as long as a Scholarship Application is submitted for the student each school year and the student remains enrolled in a Partner School. Read our ESA Guide for an overview of the ESA Program and information on choosing which funding source (tax credit scholarships or ESA) is the best option for your student.

Are scholarships awarded to families?

Per the Arizona Department of Revenue (ADOR), scholarship awards are only given to individual students. There are no family accounts.