We believe every student should have the opportunity to receive a Christian Education. Our goal is to do everything we can to make this affordable for you. Since 1998, ACSTO has awarded more than $346 million to 50,000 Arizona students. Tax credit scholarships have made it possible for thousands of families to send their children to Christian Schools—we hope your family will be one of them!

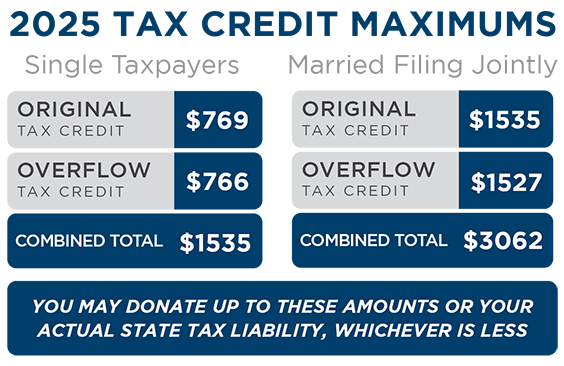

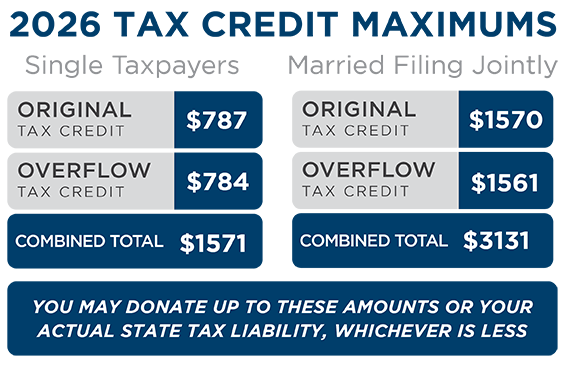

When an Arizona taxpayer makes a donation to ACSTO, they receive a dollar-for-dollar credit against their state tax liability. This means that at the end of the year, if they would normally get a refund, they'll get a bigger refund. If they normally owe taxes, they'll owe less.

In turn, we use these tax credit donations to award tuition scholarships to K-12 students attending one of our Partner Schools.

In addition, when a taxpayer donates to ACSTO, they can identify a school or recommend a student who is not their own dependent to be considered for a scholarship. By Arizona law, a recommendation does not guarantee a scholarship. However, when our Selection Committees make their award decisions, they do consider these Donor Recommendations along with the Financial Circumstances and the Narrative provided in the student's Scholarship Application.

In order to be considered for a scholarship, ACSTO needs a current Scholarship Application for each of your children. Your children must also be enrolled at the school listed on the application.

TYPES OF SCHOLARSHIPS

ACSTO awards two different types of tuition scholarships, Original and Overflow. Both of these scholarships are funded through the tax credit donations we receive. If you have completed a Scholarship Application, your student will be considered for each type of scholarship they qualify for.

Original Scholarships

Any student who is enrolled at one of our Partner Schools is eligible to be considered for an Original Tax Credit Scholarship. These scholarships are funded through donations to the Original Tax Credit.

Overflow Scholarships

If a donor maximizes their contribution to the Original Tax Credit, they may donate an additional amount to the Overflow Tax Credit. Our Overflow Scholarships are funded through these contributions. These scholarships are similar to Original Scholarships, however, only certain students qualify to receive them.

To be considered for an Overflow Scholarship, the student must be enrolled at one of our Partner Schools and also meet one of the following criteria:

- The student attended an Arizona district or charter school for at least 90 days in the prior school year, then transferred to a private school.

- The student is a preschooler with disabilities and is receiving services from a private school based on an MET or IEP they received from an Arizona public school.

- The student is currently enrolled in Kindergarten at a private school.

- The student is a dependent of a member of the U.S. Armed Forces who is stationed in Arizona under military orders.

- The student was homeschooled in Arizona and did not have an ESA immediately prior to enrolling in a private school.

- The student moved to Arizona from out of state immediately prior to enrolling in a private school.

- The student participated in the ESA program and did not renew or accept the scholarship in order to accept STO scholarships.

- The student previously received an Overflow or Corporate Scholarship in a prior year, and has attended private school continuously since.

If your student meets one of the criteria above, we can consider your student for an Overflow Scholarship once we receive the appropriate verification form or documentation shown below. Verification forms are available on our Apply Now page. If your student has already received an Overflow Scholarship from ACSTO AND remained continuously enrolled in private school since that award, you do not need to submit documentation again with future Scholarship Applications.

| Overflow Qualification | Required Documentation |

|---|---|

| Public School Students (Arizona) | Public School Enrollment Verification Form (must be completed by a district or charter school) |

| Preschoolers with Disabilities | Copy of MET or IEP from an Arizona public school; the private school must provide services to accommodate the student's specified disabilities |

| Kindergartners | No documentation is required; the student must be five years old on or before December 31 of their Kindergarten year |

| Military Dependents | Copy of active military orders showing where the parent is stationed in Arizona |

| Homeschoolers in Arizona (not using ESA) | Homeschool Verification Form AND one of the following:

|

| Out of State Students | Out of State School Verification Form |

| Student Previously Participated in ESA Program | Copy of documentation from the Arizona Department of Education stating the ESA was not renewed or was closed |

| Student Previously Received Overflow or Corporate Scholarship* | Previous Scholarship Verification Form (must be completed by the awarding scholarship organization) - OR - Copy of award letter from the awarding school tuition organization |

* To qualify with ACSTO as a previous Overflow or Corporate Scholarship recipient, the award must be from a previous school year AND the student must have remained continuously enrolled in private school since receiving the award. If the student receives an Overflow or Corporate Scholarship from another scholarship organization during the current school year, they will qualify for Overflow with ACSTO the following school year.

NOTE: By law, a completed application and/or a donor recommendation cannot guarantee a scholarship. ACSTO does not have set scholarship amounts. There is no limit to how much a student can receive as a scholarship. In the event that our Selection Committees award a student a scholarship larger than the current year's tuition, ACSTO will hold the excess as a Multi-Year Scholarship, with the excess amount to be used during the next school year. ACSTO's Selection Committees have complete discretion over award decisions.

Other Scholarship Opportunities

Arizona also offers scholarship opportunities to families considered to be low income, students with disabilities, or students who are currently or were once in Arizona's foster care system. Learn more from our sister organization, School Choice Arizona.

APPLICATIONS

Applications for the next school year become available beginning on February 3. ACSTO does not have family accounts—our Selection Committees consider each student separately when making scholarship awards. Each student requires a separate application, however, only one application is required per school year (not per award). Applications expire on May 31 of the school year shown on the application, regardless of when they are received.

Award Cycles

ACSTO has four Award Cycles per school year. Each cycle consists of an Overflow Award, followed by an Original Award, with both awards sharing an Application Deadline and a Donation Deadline. ACSTO considers every student who has a current application, is enrolled, and meets the qualifications of each type of scholarship before the cycle's Application Deadline; we award donations made by each cycle's Donation Deadline. View our Award Year Timeline for more details and deadlines.

RECOMMENDATIONS

Our Selection Committees consider three criteria when making award decisions: the Financial Circumstances of the student's family (a required factor by state law), the Narrative in the Scholarship Application, and any Donor Recommendations received for the student.

Recommendations are not required to receive a scholarship, however, the odds of receiving a scholarship do increase with recommendations. This is because without recommendations, your student only has two-thirds of the criteria our Selection Committees consider, while a student with recommendations has all of the criteria available for the committees to consider. This can be a big motivation for parents to talk to friends and family about making an ACSTO donation recommending their student(s) for a scholarship.

NOTE: By Arizona law, a recommendation cannot be the sole criteria that ACSTO uses to make an award decision. This means that, by law, recommendations cannot guarantee a scholarship. In addition, a parent cannot donate to ACSTO and recommend their own dependent, or agree to exchange recommendations with any number of parents (also known as "swapping").

KINDERGARTNERS

For the purpose of the tax credit scholarships, Kindergarten is defined as the school year immediately prior to entering first grade. To qualify for a scholarship, ADOR regulations state that a Kindergartner must turn five years old on or before December 31 of their Kindergarten year. In addition, the ADOR stipulates that parents should not knowingly enroll their student in Kindergarten with the intention of repeating it.

Tax credit scholarships may not be used to pay for preschool classes (such as Pre-K, K1-K4, kinder-bridge, kinder-care, begin-dergarten, playgroups, etc.), although the tax credit law does make exceptions for preschool students with disabilities who attend private schools that provide services to accommodate these students (A.R.S. 43-1601). For more information, please contact our office.

State regulations do not allow STOs to award scholarships to children who are too young to qualify. Donors can donate to ACSTO and recommend a child for a scholarship up to one year prior to attendance in K-12th grades at one of our Partner Schools. Recommendations received sooner than this will be considered for other children at the school identified by the donor.