Why should I donate to ACSTO?

We Are Distinctly Christian

We Are Good Stewards

We Are School Choice Champions

We Have Excellent Customer Service & Resources

How can I donate?

Donate Online: Give through our secure Donor Portal.

Donate Monthly: If you prefer to make smaller donations each month, create a donation schedule online through your Donor Portal account.

Donate by Phone: Call us at 480.820.0403 to donate by credit/debit card. Our phone hours are Monday–Friday, 9am–12pm and 1pm–4pm.

Donate by Mail: Complete a donation card and include a check, money order, or credit/debit card information. Mail donations to PO Box 6580, Chandler, AZ 85246.

When can I donate?

You may donate at any time of the year! For donations made between January 1 and Tax Day, the donor can choose to claim the tax credit for the previous or current tax year. If claiming for the previous tax year, donations must be made by the time you file your taxes or by Tax Day, whichever comes first. Even if you file an extension, your donation must be postmarked or submitted online prior to midnight on Tax Day.

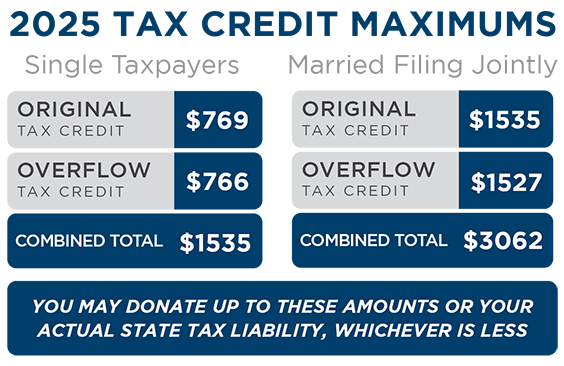

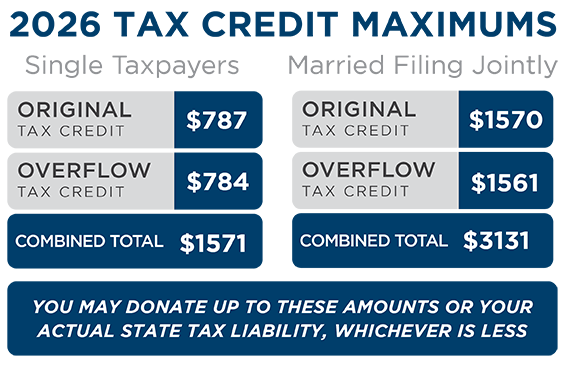

How much can I donate?

You can donate up to the combined maximum of the Original and Overflow Tax Credits, or your Arizona state tax liability, whichever is less.

Your state tax liability is the amount of money you must pay to the state in taxes based on your earnings. In exchange for your donation, the state gives you a dollar-for-dollar tax credit, essentially taking the place of what you would have to pay to the state.

To claim the Overflow Tax Credit, you must donate the maximum amount to the Original Tax Credit before any additional amount is applied to the Overflow Tax Credit, up to that credit’s allowed maximum donation.

For the current tax credit maximums, click here.

If you donate more than your tax liability, but no more than the maximum allowed, you can carry forward the difference as a tax credit to offset your state income tax liability for up to five consecutive tax years.

If you have no liability, you cannot receive a credit. However, what you give to ACSTO may be considered a charitable gift.

Will I receive a receipt?

If you have a Donor Portal account and donate through it, you may print or download your receipt right away. If you created a portal account but donate as a Guest (online), by phone, or by mail, your receipt will be available in your portal the day after ACSTO processes your donation.

For donors without a Donor Portal account, an annual receipt statement will be mailed by January 31 of the following year. If a receipt is needed sooner, please call our office at 480.820.0403.

If I already get a refund, why would I need a tax credit?

You receive a refund when you overpay toward your state taxes throughout the year.

A credit is very different from a refund. Dollar for dollar, a credit offsets the tax you owe the state. Arizona gives you credit for each dollar you donate up to your state tax liability or the stated maximum, whichever is less.

When you take advantage of a tax credit, if you normally get a refund, you’ll get a bigger refund! Likewise, at the end of the year, if you typically owe tax, you’ll owe less or now receive a refund.

How do I claim my credit on my state tax return?

Donations to ACSTO for the Original Tax Credit are claimed using Arizona Form 323. Donations made for the Overflow Tax Credit are claimed using Arizona Form 348. If claiming any tax credits, you will also need to complete Form 301. Forms are available on our Claim Your Credit page or at AZDOR.gov. We also suggest watching Claim Your Tax Credit, our quick video walk-through of these forms. If using common tax preparation software, it should ask you about any giving you did during the year and account for your tax credit donation automatically.

Are there other tax credit opportunities?

Arizona offers several other tax credit opportunities for charitable organizations, foster care, public schools, and military families. A taxpayer may donate to as many of the various tax credit programs as they like—as long as they have the state tax liability to do so. Visit AZDOR.gov for more information.

Do I need a code to claim my tax credit?

No. Unlike Arizona’s charitable, foster care, and public school tax credits, the Private School Tax Credit does NOT require an organization/school code to claim the credit on your state taxes. If a code is requested, please confirm you have selected the Private School Tax Credit, or that you are using Arizona Form 323 (and Form 348, depending on your donation amount).

Is my donation eligible for a federal deduction?

Please consult your tax advisor for specific advice concerning deductibility for your tax situation.

How much of my donation is awarded as a scholarship?

Arizona law requires that 90% of donated funds are awarded as scholarships. ACSTO awards 92%! We operate on an 8% budget which is used to pay for operating costs and numerous resources for our schools, parents, and donors.

Can I recommend a specific school or student with my donation?

Yes, you may identify a specific school and your donation will be used to award scholarships among applicants from that school. A current list of our Partner Schools is available here.

In addition, you may also recommend an eligible K-12 student (or preschooler with disabilities) who is not your child or dependent. Please note, Overflow Scholarships can only be awarded to students who qualify to receive them.

Families may not “swap” donations by recommending each other’s children. The law states, “A taxpayer may not claim a tax credit if the taxpayer agrees to swap donations with another taxpayer to benefit either taxpayer’s own dependent.”

What is the difference between a donor recommendation and a scholarship award?

A donor recommendation is just that, a recommendation. By law, a school tuition organization (STO) cannot guarantee a scholarship award based solely on the recommendation of a donor. Recommendations are considered and are helpful in the scholarship award process, but they are not the only factor.

Scholarship awards are made by our Selection Committees on a quarterly basis. In addition to any donor recommendations received, the committees consider the family financial information (required by state law) and the student narrative provided in the student’s Scholarship Application.

Can an STO let parents know who recommended their child for a scholarship or the amount donated?

Per the Arizona Department of Revenue (ADOR), donor names may not be shared with scholarship recipients. In addition, as a 501(c)(3) charitable organization, we are required by federal law to maintain donor confidentiality.

Arizona tax credit law prohibits STOs from awarding, designating, or reserving scholarships based solely on a donor’s recommendation. Therefore, donation amounts for recommendations are not disclosed since there are no guarantees to scholarships that have not been awarded yet.