Give Without Affecting Your Take-Home Pay!

Arizona's withholding tax reduction law (A.R.S. 43-401) allows individuals to authorize their employer to send their state withholding tax amount to ACSTO as a dollar-for-dollar tax credit donation! It counts the exact same as if you made your tax credit donation in one lump sum, but this way you donate smaller amounts throughout the year—without affecting take-home pay.

You can donate to ACSTO through your Arizona state tax withholdings with our simple sign-up process.

- Check with your employer to see if this is a benefit they are willing to provide.

- Fill out a Withholding Pledge Form (see below), then mail or email it to ACSTO.

- ACSTO will return an Authorization Form within one business week. Review the form and fill in the necessary information. Sign, keep pages one and two for your records, and give pages three and four to your employer.

- Your employer, if they agree to participate, will reduce your state tax withholdings per pay period and will send that amount to ACSTO on your behalf (instead of sending it to the state).

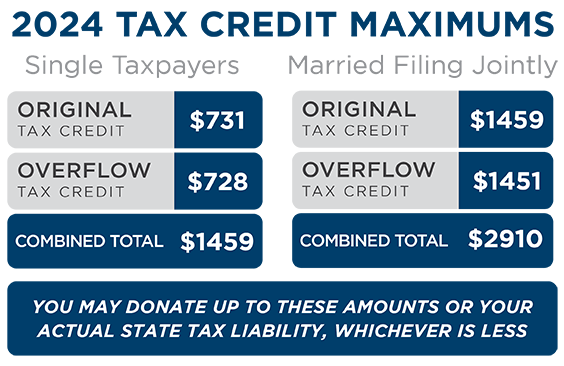

Once it is set up, donations are automatic for the rest of the year, and will automatically stop once your donation limit is reached (a limit you indicate on our pledge form).

What are you waiting for—see if your employer will provide this benefit today!

For Employees

| 2024 | |

|---|---|

| Withholding Pledge Form | |

| Withholdings Brochure |

For Employers

| 2024 | |

|---|---|

| A1-QTC Form* (optional) | |

| A1-QTC Form Instructions |

*Employers can use the A1-QTC form or their own substitute when sending in the quarterly payment to ACSTO of reduced withholdings for tax credits.